Market & Performance Summary

The bond market staged a remarkable rebound this quarter, with the Aggregate Bond Index[1] delivering its highest monthly return in November since May 1985. For the quarter, the index boasted a 6.8% return, contributing to a year-to-date increase of 5.5%. At Kovitz, client bond portfolios produced similar returns for the year.

For the first time in a long time, bond returns were driven by income instead of price fluctuations. The 5.5% return for the Agg Index closely aligns with the benchmark’s 4.6% yield at the start of the year. Despite the roller coaster in rates throughout the year, the starting point for the bond market yield is once again 4.6%, which sets a stable foundation for the year ahead.

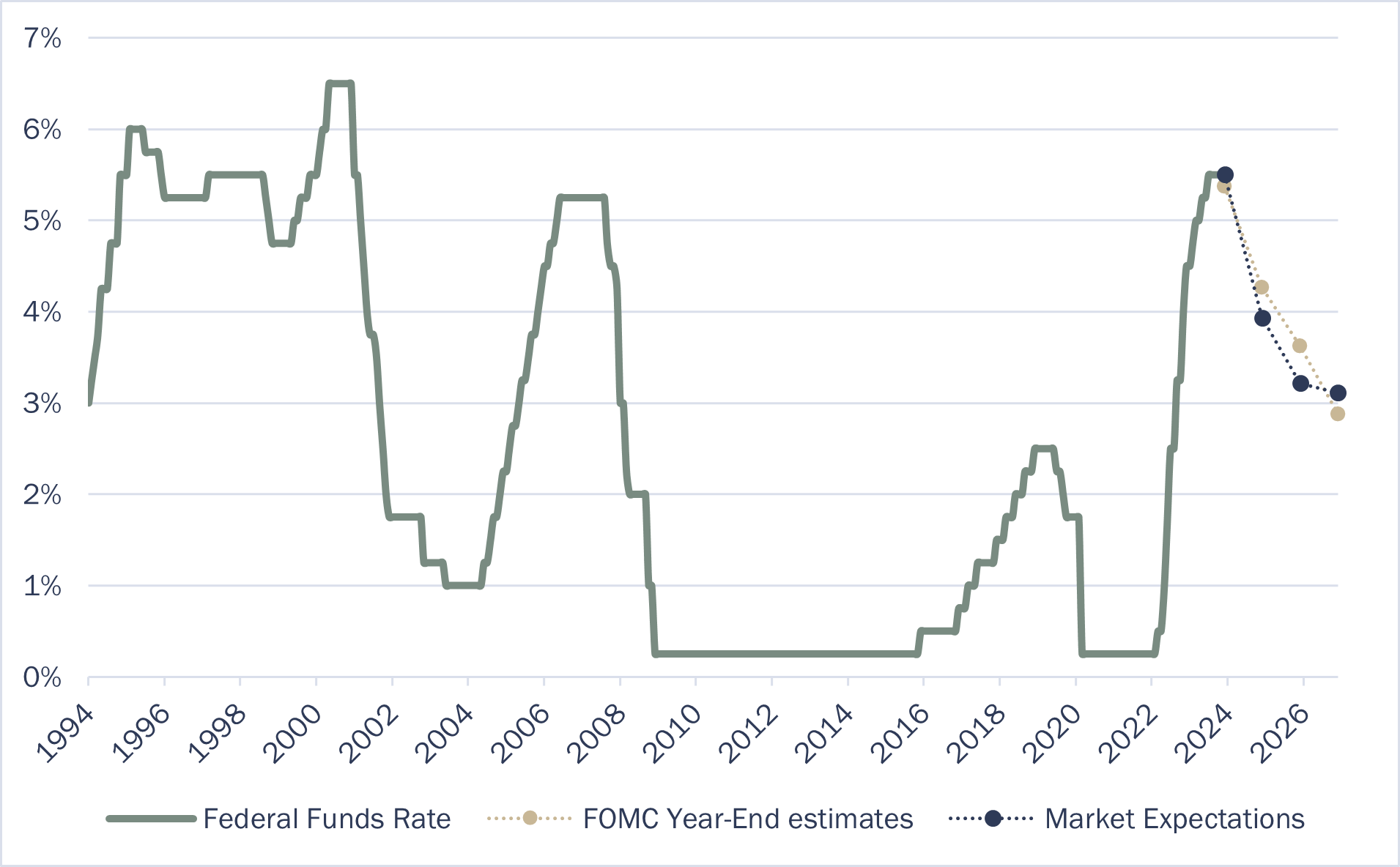

Interest rate volatility has been driven by the Federal Reserve, as its rate-setting arm, the Federal Open Market Committee (FOMC), made a notable shift in policy stance this quarter. Following an aggressive rate-hiking cycle, the FOMC opted to hold rates steady throughout the quarter. With inflation approaching the Fed's 2% target and growth decelerating, many interpreted this shift as a pivot in focus toward potential future decreases in interest rates.

In fact, FOMC projections anticipate a 0.75% reduction in the fed funds overnight rate in 2024, potentially starting with a 0.25% cut as early as March. Long-term expectations implied by the shape of the yield curve indicate short-term rates may approach 3% by the end of 2026. Although the economy has displayed resilience to higher rates, navigating a soft landing amidst the lagged effects of rate impacts remains a complex challenge.

With most inflationary risks in the rearview mirror, short-term interest rates appear to be headed lower, but the focus for 2024 will be on how low they’ll go and how quickly they’ll get there.

Figure 1: Federal Funds Rate Expectations

FOMC and Market Expectations for the Federal Funds Rate

Source: Kovitz using data from Bloomberg Finance, L.P.

2024 Outlook: Opportunities & Challenges

Despite lingering uncertainties, we believe 2024 presents fertile ground to cultivate compelling fixed income returns:

· Navigating the Inverted Curve: The current inverted yield curve, where short-term yields surpass longer-term ones, requires careful consideration of reinvestment risk. While cash-like instruments might offer seemingly higher yields now, future interest rate reductions could lead to lower total returns. In short, reconsider excess cash.

· Embrace Real Returns: While bond yields remain near two-decade highs, we believe the true value in fixed income as a wealth creator should be viewed through an after-inflation lens – also known as “real return”. For the first time in a long time, the high-grade bond market offers after-tax returns that comfortably exceed expected inflation rates, which increases the attractiveness of these bonds.

· Asymmetric Return Skew: With bond yields to start the year still higher than for most of the past decade, income generation provides a cushion that should offset much of the volatility in the interest rate market. Barring a significant increase in interest rates, this creates a landscape where posting negative returns is mathematically challenging while presenting favorable conditions for positive returns, thus making the role of fixed income allocations increasingly defensive.

· Quiet Credit Concerns: While credit stresses are currently concentrated in specific sectors like commercial real estate, the unwinding of a decade-long low-interest-rate era carries the real potential for turbulence. With credit spreads – representing the excess yield demanded by the market to bear default risk – back to their lowest point in two years, there is a sense of excessive complacency among bond market participants.

· Focus on Liquidity: In a landscape where risk compensation is low, maintaining sufficient liquidity is critical. It ensures adaptability to capitalize on market stresses or unforeseen developments, emphasizing the prudence of a modest allocation to liquid Treasury bonds and a focus on high-quality credits.

CONCLUSION

2024 presents a unique inflection point for the fixed income market. While the Fed's dovish pivot sparks renewed optimism, the lingering concerns of economic turbulence and historical missteps by the central bank warrant a cautious approach. Amid these uncertainties, the convergence of high starting yields, moderating inflation, and the potential easing by the Fed presents compelling opportunities for core bond investors. By prioritizing long-term stability, focusing on high-quality credit, and actively managing portfolio duration and structure, we believe investors can capitalize on the opportunities in fixed income that lie ahead.

[1] Measured using the Bloomberg U.S. Aggregate Bond Index.

DISCLOSURES

Kovitz Investment Group Partners, LLC (“Kovitz”) is an investment adviser registered with the Securities and Exchange Commission. The information and opinions expressed in this publication are not intended to constitute a recommendation to buy or sell any security or to offer advisory services by Kovitz. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to participate in any trading strategy, and should not be relied on for accounting, tax, or legal advice. This report should only be considered as a tool in any investment decision matrix and should not be used by itself to make investment decisions.

Kovitz Investment Group Partners, LLC (“Kovitz”) claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. Kovitz has been independently verified by The Spaulding Group for the periods January 1, 1997 through December 31, 2022. The verification report(s) is/are available upon request. A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm’s policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis. Verification does not provide assurance on the accuracy of any specific performance report. GIPS® is a registered trademark of the CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

Opinions expressed are only our current opinions or our opinions on the posting date. Any graphs, data, or information in this publication are considered reliably sourced, but no representation is made that it is accurate or complete, and should not be relied upon as such. This information is subject to change without notice at any time, based on market and other conditions. Past performance is not indicate of future results, which may vary.