What's Trending

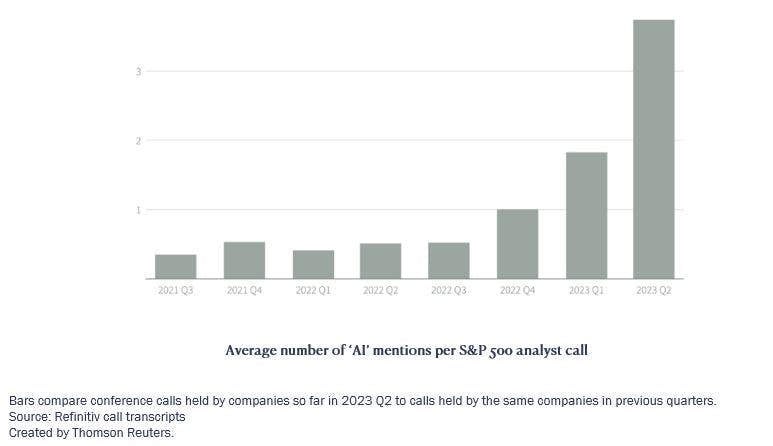

Discussions about how artificial intelligence (“AI”) is going to “change the world” are all the rage in business conversations today. According to Reuters, AI was mentioned 827 times on 76 separate company earnings conference calls where the term was used during the third quarter.[1]

It’s no wonder business leaders have taken up the topic. There are significant dollars attached to involvement in AI, particularly generative AI (GenAI), which for-profit research lab OpenAI[2] popularized with its consumer app, ChatGPT. ChatGPT seemed to convey sentience in its responses to human queries, and it and similar models have captured not only the imagination but also significant investment interest. Semiconductor designer Nvidia’s May 24th quarterly earnings report was highlighted by an announcement of rapidly growing demand for its processors that are used to train and run GenAI systems. Nvidia stock appreciated 24% the next day, adding over $180 billion to its market capitalization.[3] The stocks of other companies thought to benefit from GenAI products also rallied in the wake of Nvidia’s announcement.

A recent Accenture survey revealed that “97% [of global CEOs] said that GenAI will be transformative to their company and industry” and that “67% of organizations are planning to increase their levels of spending in technology, …prioritizing investments in data and AI.”[4]

The AI Ecosystem

We have been studying the topic as we have assessed the AI exposures of our investment holdings and prospective investments. We have also been asked as investors what we are doing to capitalize on this emerging opportunity.

It seems clear to us that many questions related to AI are implicitly about cost savings from replacing human capital with digital tools, or they are about revenue opportunities from products that might capitalize on GenAI’s abilities to enhance experiences and products.

We believe there are multiple functional layers to GenAI [5]. First, there’s a massive amount of data required to train the large language models to do inference and make predictions. We believe it takes a unique company to have enough data and the financial wherewithal to train these models. The large cloud service providers, including Microsoft, Amazon, and Alphabet, have invested the billions of dollars to do this and now offer their models as a service to other businesses. Additionally, the data centers where all this computing power is housed require a great deal of equipment and chips from a vast array of vendors, which further rely on another layer of companies whose products facilitate the manufacture and research and development necessary to advance GenAI.

At the user level, or software application level, are the products like ChatGPT, Google’s Bard, and Adobe Firefly that allow users to prompt the applications for content production. Right now, it appears that some emerging business use cases for GenAI include having it act as a coding companion to computer programmers and for advertising content generation. We exclude the production of high school and college essays as business use cases.

Our Thoughts

The short answer to the question on whether we’re taking significant actions to capitalize on AI is “no.” A bit of explanation is in order, though. First, we observe that the investment markets have adjusted to price in a good degree of success from GenAI before the economics can be reasonably conceptualized, much less quantified. We’re not of the mind to chase investments in speculative markets, but instead prefer patient study and thought about the investment opportunity set with the goal of finding select, underpriced investments. Right now, that seems unlikely, but such opportunities invariably arise over the course of time. Second, we feel that we already have significant exposure to the AI ecosystem through several current holdings. For example, Analog Devices provides tools to harvest the data necessary for AI in Internet-of-Things applications. Other holdings, like Amazon, Alphabet, and Meta, provide the foundational compute infrastructure to train large language models to do inference and make predictions and then distribute GenAI as a service; moreover, they’ve already utilized AI for years as key recommendation engines in their products. In addition, Arista Networks builds the network architecture in datacenters while Keysight Technologies tests and verifies nearly all the essential electronic tools across the hardware systems. We also have material exposure to other companies, ranging from Apple to Salesforce.com to our banking businesses, that use AI in their core products and will augment their offerings as GenAI evolves.

We’re a few steps into a marathon.”

ANDY JASSY, AMAZON CEO

When asked recently about GenAI, Amazon CEO Andy Jassy commented that “We’re a few steps into a marathon.” We agree, and we think the business cases are nascent with very few companies generating present economics from the new technology. It’s been said that a new technology’s impact is often overestimated in the short-run but is underestimated in the long-run.[6] That maxim particularly resonates with us today. Our sense is that there is a fair degree of inflated hype with GenAI at present. If that’s the case, we’re comfortable with our assessment that our holdings are selling the “picks and shovels” for the gold rush. As it concerns how we plan to allocate investment capital going forward, we will continue to be guided by our fundamentally-driven valuation and risk-assessment processes that we’ve relied on over time.

That is, as always, we’ll be guided by value.

--

[1] https://www.reuters.com/technology/companies-double-down-ai-june-quarter-analyst-calls-2023-07-31/#:~:text=The%20terms%20%22AI%22%20or%20%22,the%20same%20time%20last%20quarter

[2]https://en.wikipedia.org/wiki/OpenAI

[3]https://www.nytimes.com/2023/05/25/business/dealbook/nvidia-outlook-artificial-intelligence.html

[4] Accenture plc, Q3 2023 Earnings Call, June 22, 2023.

[5] Amazon.com’s 2Q conference call was a resource we thought was helpful to contextualize the structure of the GenAI ecosystem.

[6] Stanford computer scientist Roy Amara is attributed the quote, “we overestimate the impact of technology in the short-term and underestimate the effects in the long-run” as he reportedly commented in the 1960s.

Disclosures

Opinions expressed are only our current opinions or our opinions on the posting date. Any graphs, data, or information in this publication are considered reliably sourced, but no representation is made that it is accurate or complete and should not be relied upon as such. This information is subject to change without notice at any time, based on market and other conditions. The description of products, services, and performance results contained herein is not an offering or a solicitation of any kind, always consult with your tax advisor.

Definition of the Firm: Kovitz Investment Group Partners, LLC (Kovitz) is an investment adviser registered under the Investment Advisers Act of 1940 that provides investment management services to individual and institutional clients. From October 1, 2003, to December 31, 2015, the Firm was defined as Kovitz Investment Group, LLC. Effective January 1, 2016, Kovitz Investment Group, LLC underwent an organizational change and all persons responsible for portfolio management became employees of Kovitz. From January 1, 1997, to September 30, 2003, all persons responsible for portfolio management comprised the Kovitz Group, an independent division of Rothschild Investment Corp (Rothschild).

The description of products, services, and performance results contained herein is not an offering or a solicitation of any kind. Past performance is not an indication of future results. Securities investments are subject to risk and may lose value.

Kovitz Investment Group Partners, LLC (“Kovitz”) is an investment adviser registered with the Securities and Exchange Commission. The information and opinions expressed in this publication are not intended to constitute a recommendation to buy or sell any security or to offer advisory services by Kovitz. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to participate in any trading strategy, and should not be relied on for accounting, tax or legal advice. This report should only be considered as a tool in any investment decision matrix and should not be used by itself to make investment decisions.

Posted by

Kovitz