On September 13, 2021 the House of Representatives’ Ways and Means Committee announced a new Tax Bill entitled, “Build Back Better” (BBB).

While the BBB has many facets which impact the economy the focus is on higher federal ordinary income taxes and capital gains (for those considered top tier earners), as well as, a reduction on federal gift and estate taxes, and an elimination of several effective estate planning techniques. In our three-part series we break down the BBB into three high level categories: 1. Federal Income Taxes, 2. Retirement Planning, and 3. Estate Planning.

Part 1: Federal Income Taxes

Higher Ordinary Income Tax Rates at 39.6%

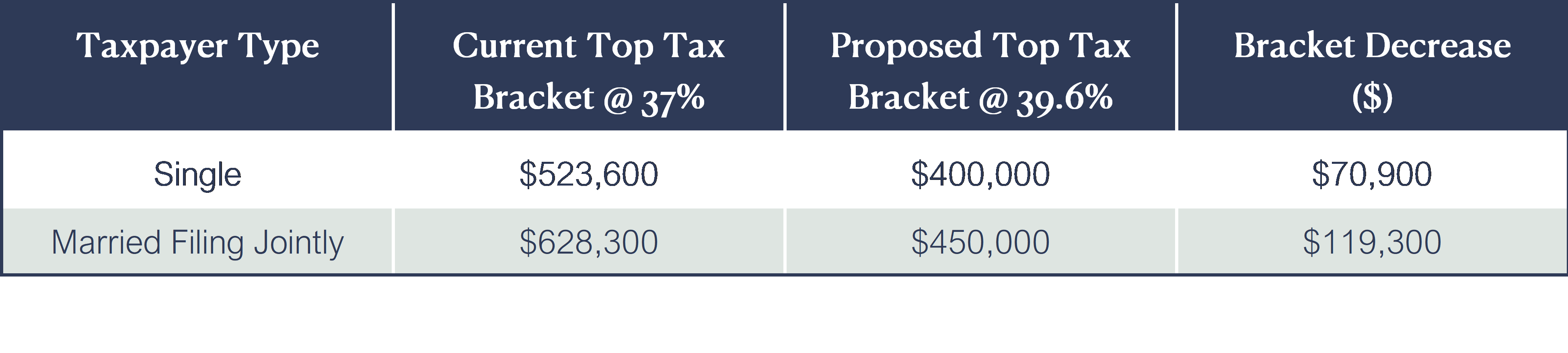

The BBB proposes to raise the top tax bracket on federal ordinary income taxes from 37% to 39.6%[1], restoring the pre-TCJA (Tax Cuts and Job Act) rates[2]. In addition to raising the rate by 2.6% the BBB also lowers the threshold to be subject to those top rates.

For example, assume you are a married couple with $500,000 of ordinary income. Under the current TCJA you will not reach the top bracket of 37%, however under the new BBB you will, at just $450,000, and any income in excess of that will be taxed at 39.6%.

As a result, you see that BBB simultaneously increases the top tax rate while subjecting more taxpayers to that rate by lowering the bracket by $119,300.

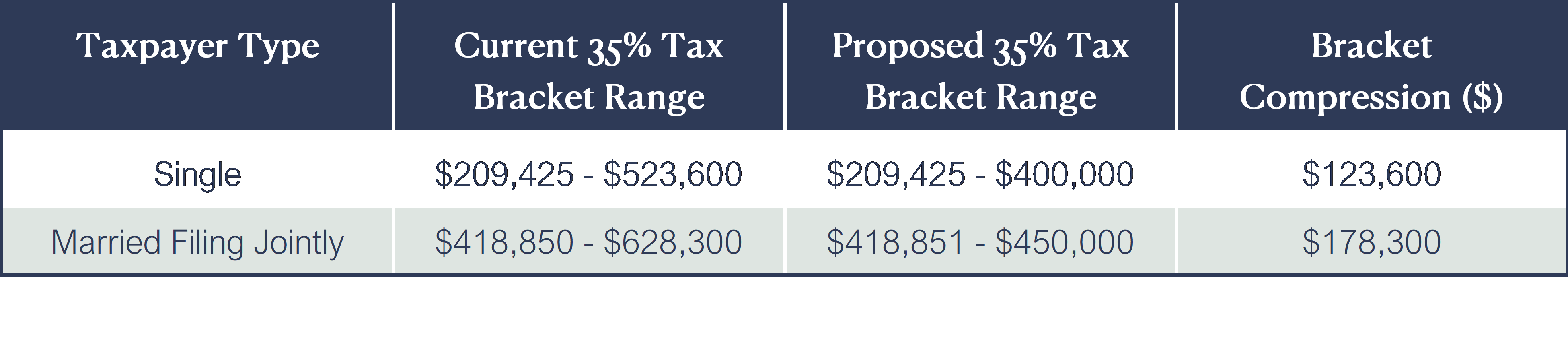

Particularly impacted by this tax brackets squeeze are those taxpayers currently subjected to 35% federal ordinary income taxes under TCJA. The chart below summarizes the new proposed 35% tax bracket. For couples MFJ the range is $418,851-$450,000 – a tax bracket compression of $178,300. Not only have they moved up one tax bracket level – into the highest paying tax group – but the new bracket level will increase by 4.6%. The increase from 35% to 39.6% imposes an effective increase in taxes of over 13%[3].

Long-Term Capital Gains Rates at 25% as of September 14, 2021

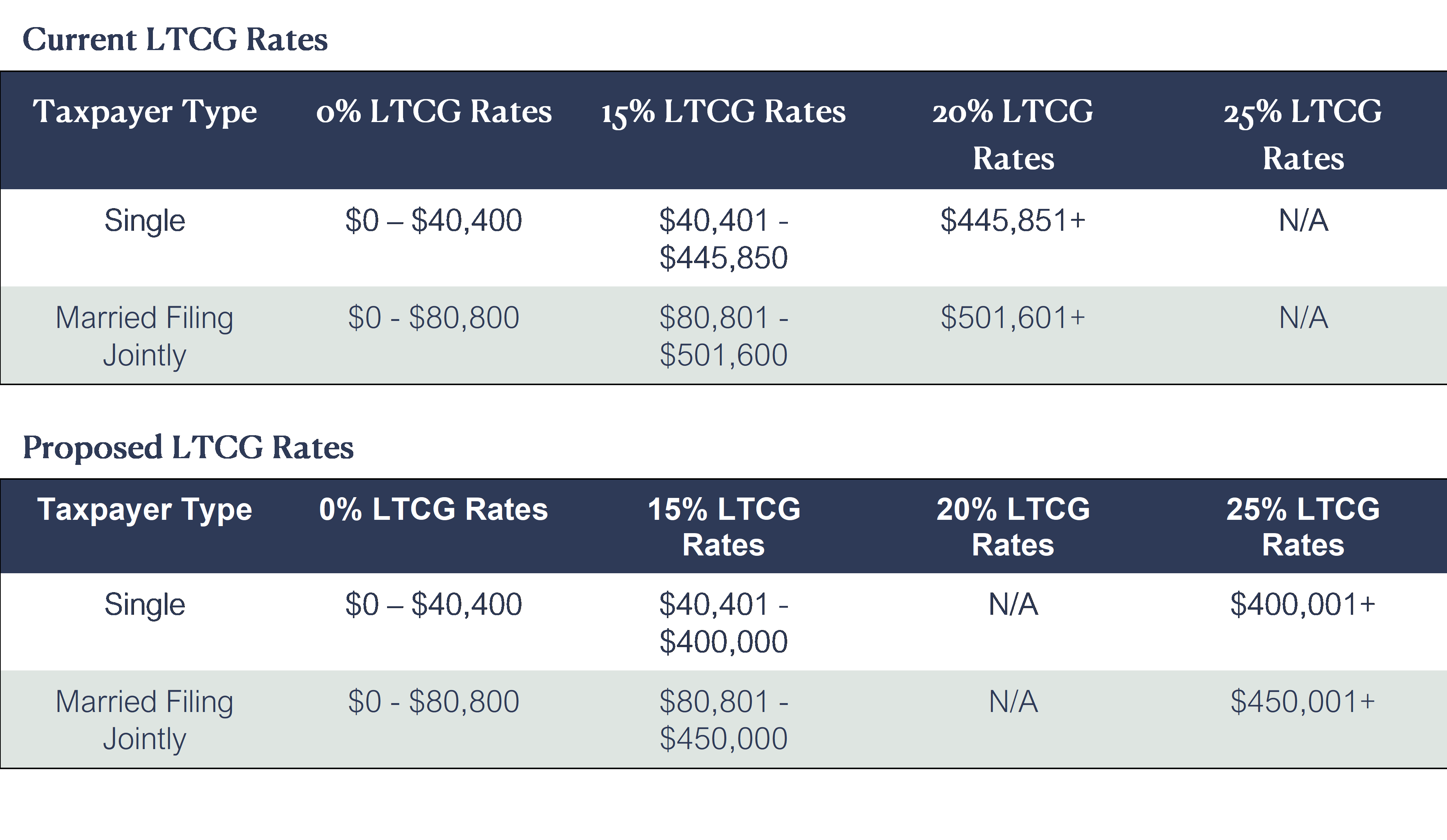

While ordinary income taxes would not go into effect until 2022 under BBB, the start date of higher Long-Term Capital Gains (LTCG) Rates would be as of the day after the BBB Bill was proposed – on September 14, 2021[4]. Therefore, while some taxpayers might be able to accomplish end of year tax planning from an ordinary income tax perspective, the same taxpayers will not – as currently proposed – be able to accelerate LTCGs to avoid higher tax rates. Similar to ordinary income taxes, LTCGs rates are being increased at the highest level from 20% to 25% while lowering the income threshold to enter the top rate – from $501,601+ to $450,001+. Again, taxpayers in the current TCJA 35% tax bracket are unproportionally impacted by BBB proposals as those individuals now enter the top LTCG rate which has increased by 10% for them.

New 3% Surtax on Ultra - High Income Taxpayers

For taxpayers with a Modified Adjusted Gross Income over $5,000,000, BBB would apply an additional 3% surtax to ordinary income rates bringing the top federal tax rate to 42.6%[5]. Taxpayers are most likely to be impacted by this threshold when they incur a large transaction or event (i.e., a sale of a business or real estate) as compared to W-2 or 1099 Income. While the threshold is high for individual taxpayers, for an Estate or Trust, the 3% surtax begins at $100,000 not $5,000,000. Given the low threshold to enter the 42.6% threshold, taxpayers will need to weigh whether long-term asset growth out of their taxable estate (for estate tax purposes) is worth having those assets being subjected to the highest income tax rate.

Next Steps

BBB proposals are subject to change through the Legislative and Democratic process. We encourage you to reach out to your Wealth Advisor as soon as reasonable to discuss how you might be impacted by these changes and what appropriate next steps might be. If BBB is enacted, there will be limited time – if any – to implement appropriate changes for individuals.

Continue to Part 2: Retirement Planning

Disclosures

It should be noted from the onset that BBB is a Tax Proposal which has not been approved by the Senate nor has it been presented to President Joe Biden for approval as of publication. All tax proposals might be subject to significant changes as the Bill is negotiated further in Congress. The above Insight is intended to provide a high-level overview of the items which Congress is seeking to address through Tax Legislation. Time is of the essence before new Tax Laws are enacted. Opinions expressed are only our current opinions or our opinions on the posting date. Any graphs, data, or information in this publication are considered reliably sourced, but no representation is made that it is accurate or complete, and should not be relied upon as such. This information is subject to change without notice at any time. Please reach out to your Wealth Advisor to learn more information as well as seek the appropriate Tax counsel from your Attorney and/or Accountant.

[1] BBB Bill Section 138201

[2] Tax Cuts and Jobs Act was enacted by President Donald Trump on December 20, 2017.

[3] By comparison, the increase from 37% to 39.6% imposes an effective increase in taxes of approximately 5.4%.

[4] BBB Bill Section 138202

[5] BBB Bill Section 138206

Posted by

Kovitz